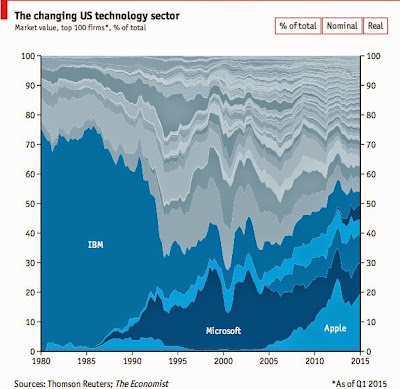

"When Steve Jobs returned to Apple in 1997, it was valued at $3bn, less than one-tenth of Siemens, Europe’s largest industrial group then and now. Today, Apple is worth more than Germany’s 30 leading companies."

Exponential Innovations Everywhere

* * *

Joost Bonsen's Opinions on How Money, Ideas, and Talent can

Enable Health, Wealth, and Happyness for Each plus Achieve Liberty, Prosperity, and Vitality for All and Ultimately Help Us Spread Beyond Our Cradle Planet Earth

"When Steve Jobs returned to Apple in 1997, it was valued at $3bn, less than one-tenth of Siemens, Europe’s largest industrial group then and now. Today, Apple is worth more than Germany’s 30 leading companies."

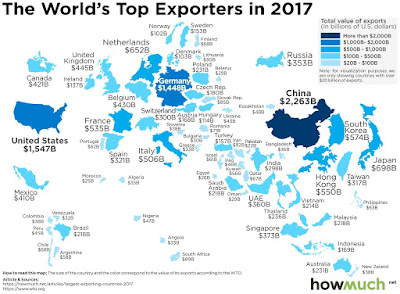

"We got our numbers from the World Trade Organization [...] The WTO tracks the total value of physical goods each country sends across its borders. Remember, these numbers exclude services -- we are only focused on physical items. To create our map, we changed the size of the country depending on the value of exports, and we likewise added a shade of blue for easy reference. This approach highlights the outliers and identifies several key trends."

"Founded in 1911 as a manufacturer of punch-card machines, more than a century later IBM remains one of the largest technology companies in the world. But the days of Big Blue’s dominance are long past. It was recently surpassed in market value by Facebook, a company barely a decade old..."

"The world's largest fish market -- hundreds of kinds of seafood from around the world are sold there. 40,000 people work at Tsukiji each day, and hordes of foreign tourists come to check out the vast, buzzing hive of activity. This time [...] we explore the customs and commerce of Tsukiji Market. Our guest is Masataka Fujiwara, a seafood expert who's been visiting Tsukiji regularly for more than 30 years."And here's more intimate details...

"'Barcelona? It's a theme park.' Spain's second city is so effortlessly attractive that it's hard to believe anyone could fall out of love with it. A new documentary called Bye Bye Barcelona, however, shows some long-term residents wondering aloud how much longer they can stay where they are. The problem? Tourism, specifically a local industry that has become so dominant it risks stifling ordinary, everyday life in the city's heart."

"Rhythm & Hues Studios, the L.A. based Visual Effects company that won an Academy Award for its groundbreaking work on "Life of Pi" -- just two weeks after declaring bankruptcy. The film explores rapidly changing forces impacting the global VFX community and the Film Industry as a whole."

This nearly 200 year vista is lovely, especially his addition of (a) blue bars = tech growth pulses with start year and duration, and (b) green bars = life expectancy of Americans in years.

This nearly 200 year vista is lovely, especially his addition of (a) blue bars = tech growth pulses with start year and duration, and (b) green bars = life expectancy of Americans in years.

"Differences in metropolitan populations may help explain gaps in productivity and incomes. Western Europe’s per-person GDP is 72% of America’s, on a purchasing-power-parity basis. A recent study by the McKinsey Global Institute, the consultancy’s research arm, reckons that some three-quarters of this gap can be chalked up to Europe’s relatively diminutive cities. [...] Cities today have a productivity advantage for different reasons, to do with ideas rather than costs. When one firm in a city comes up with a new technique, product or design, nearby firms may quickly build on it or hire its creator. One firm’s innovation boosts its own productivity but also spills over to other businesses. Companies that prefer seclusion cut themselves off from these "knowledge spillovers."

"...a financial structure in which a large number of biomedical programs at various stages of development are funded by a single entity to substantially reduce the portfolio’s risk. The portfolio entity can finance its activities by issuing debt, a critical advantage because a much larger pool of capital is available for investment in debt versus equity. By employing financial engineering techniques such as securitization, it can raise even greater amounts of more-patient capital."To exemplify this, they propose a cancer megafund. Read the paper for more details, but these illustrate flows...

"Edward Bernays, aka the godfather of spin and the forefather of modern PR"

"The films focus on three treasured places in the public trust that are threatened by private mining and drilling proposals, including areas around the Grand Canyon that are still open to uranium mining, a proposal to expand coal mining near Bryce Canyon National Park in Utah and the introduction of natural gas drilling around Bridger-Teton National Forest in Wyoming. [What is] appropriate use of the 700 million acres of public lands that belong to all Americans."See trailer...

"The adult industry is notoriously innovative, and it’s going through the same technological disruption as other entertainment industries in the Internet age. [...] When I looked for research on the subject, I couldn’t find very much, so I decided to do it myself. [...] Adult entertainment has always been in tremendous demand. Also, many new media formats have increased privacy and convenience, which is something that consumers value highly. Another reason may be that the adult industry has never really had the option of fighting technological change. [...] As with previous technological disruptions, the companies that figure out ways to use this new architecture to their advantage rather than spend all of their resources trying to stop it are more likely to win in the end. [...] once the current dust settles, I think we will be left with some highly professional, smart, competitive players, and I think that they have a good shot at surviving, and even thriving."Finally, Darling answers the obligatory question about sexbots...

"I’m fascinated with all of the directions that social robotics is taking and truly hope we manage to develop sophisticated sex robots"Be sure to read the full, uncut interview;-)

"There is growing interest in the role of market-based solutions in addressing the problems of poverty, through inclusive businesses that tap into the potential of the global poor as customers and suppliers -- the so-called ‘fortune at the Base of the Pyramid (BoP).’ EncouragedRead the full report.by the growth of microfinance, many promising new models are emerging. This has elicited a rush to the new field of ‘impact investing’ -- producing social or environmental good as well as financial return -- with hundreds of funds set up in just a few years and billions of dollars waiting to be invested. But many investors report that they are struggling to find good opportunities in which to invest for impact. [Indeed] impact capital alone will not unlock the potential of impact investing for the global poor. Because of the extreme challenges facing those who are pioneering new models for inclusive business, truly realizing the impact in impact investing will require more, not less, philanthropy, and will need that philanthropic support to be delivered in new ways."