Barron's Gene Epstein writes about

Corporate Tax Hurdles...

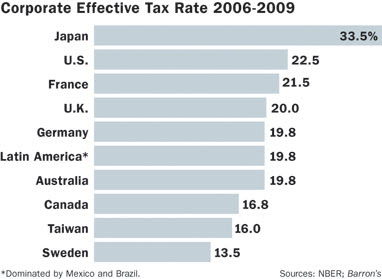

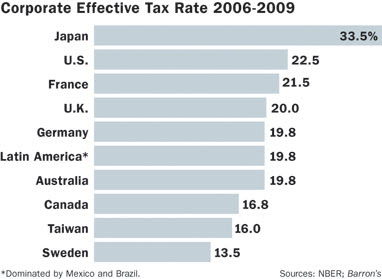

"Does a high corporate tax hurt a country's economic growth and global competitiveness? "The Effect of Corporate Taxes on Investment and Entrepreneurship," a study published last year by the American Economic Association, found a "large adverse impact" from high corporate tax rates on aggregate investment and entrepreneurial activity. In any case, even if the U.S. trimmed its corporate rate a bit more, it still wouldn't be low, relative to other countries'. Japan, whose economy has been stagnant for years, might want to ponder this."

1 comment:

Effective corporate tax rates are levied on declared profits and rules in each country vary dramatically.

Therefore, a more intellectually honest way to compare inter-country effective corporate tax rates is the percentage of total corporate revenues paid.

US = 3.01%,

Developed Europe = 2.51%,

Australia, NZ, Canada = 3.38%, Japan = 2.39%,

Emerging markets, 3.15%.

The world average is 2.82%.

On this basis US effective corporate rates are not out of line, while Japan's rate is the lowest.

Data can be found here: http://aswathdamodaran.blogspot.com/2011/01/tax-policy.html

This blog is much better when you refrain from teabagger fantasies.

Post a Comment